= Live

= Live

🟡 = Testing in progress

| Scenario | Expected Behavior | Functional? | Tax? |

| HB Finance - partial instant refund | Creates a refund receipt in QuickBooks and a separate transaction in the bank feed to match to the refund receipt | ✅ | 🟡 |

| HB Finance - full instant refund | Creates a refund receipt in QuickBooks and a separate transaction in the bank feed to match to the refund receipt | ✅ | 🟡 |

| HB Finance - partial refund (after bank posting) | Creates a refund receipt in QuickBooks and a separate transaction in the bank feed to match to the refund receipt | ✅ | 🟡 |

| HB Finance - full refund (after bank posting) | Creates a refund receipt in QuickBooks and a separate transaction in the bank feed to match to the refund receipt | ✅ | 🟡 |

| HB Finance - full or partial refund of an ACH payment (can only be done after bank posting) | Creates a refund receipt in QuickBooks and a separate transaction in the bank feed to match to the refund receipt | ✅ | 🟡 |

| NON-HB Finance - partial instant refund | Bank deposit in QuickBooks is automatically updated to reflect updated partial payment amount that will hit the bank and match partial payment transaction shown in the bank feed | ✅ | 🟡 |

| NON-HB Finance - full instant refund | Bank deposit in QuickBooks is automatically updated to reflect updated payment amount to $0 since there will be no money hitting the bank, therefore there will be no matching transaction in the bank feed | ✅ | 🟡 |

| NON-HB Finance - partial refund (after bank posting) | Creates a refund receipt in QuickBooks and a separate transaction in the bank feed to match to the refund receipt (5 days later) | ✅ | 🟡 |

| NON-HB Finance - full refund (after bank posting) | Creates a refund receipt in QuickBooks and a separate transaction in the bank feed to match to the refund receipt (5 days later) | ✅ | 🟡 |

| NON-HB Finance - full or partial refund of an ACH payment (can only be done after bank posting) | Still in testing | 🟡 | 🟡 |

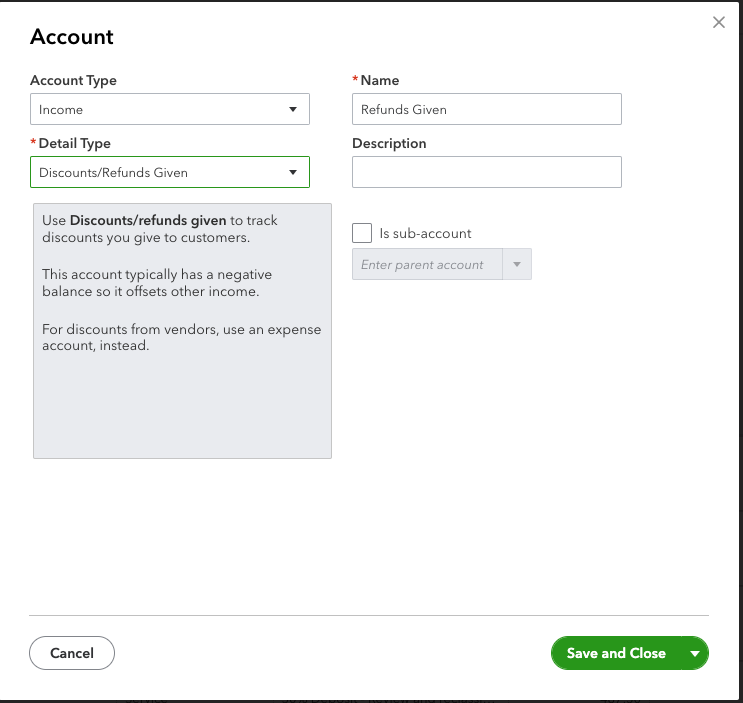

Refunds with sales tax - Currently all refunds are mapped to the “refunds issued” chart of accounts (selected on the QuickBooks dashboard). We are working to ensure that refunds with sales tax behave accurately in QuickBooks, including coming off of the various reports and liability account. Stay tuned for updates on this. In the meantime, feel free to continue to invoice and refund with sales tax - we will include a guide on how to manage the sales tax in QuickBooks!

For now, the “payments completed” report includes refunds if you export it and filter by status “full or partial refund”.

For now, the “payments completed” report includes refunds if you export it and filter by status “full or partial refund”.