Below you’ll find a high-level explanation of each new piece of the updated QB integration with both the current behavior explained along with the new experience. To learn more about the individual feature and watch a video walkthrough, click “How it Works” in each feature’s New Experience box. At the bottom of the page you will find a list of features we’re currently working on, and others that will not be able to be included in this integration at this time though we know they are requested features and we wish we could! We are limited by what is possible when integrating with Quickbooks itself.

Connection Experience & New Dashboard

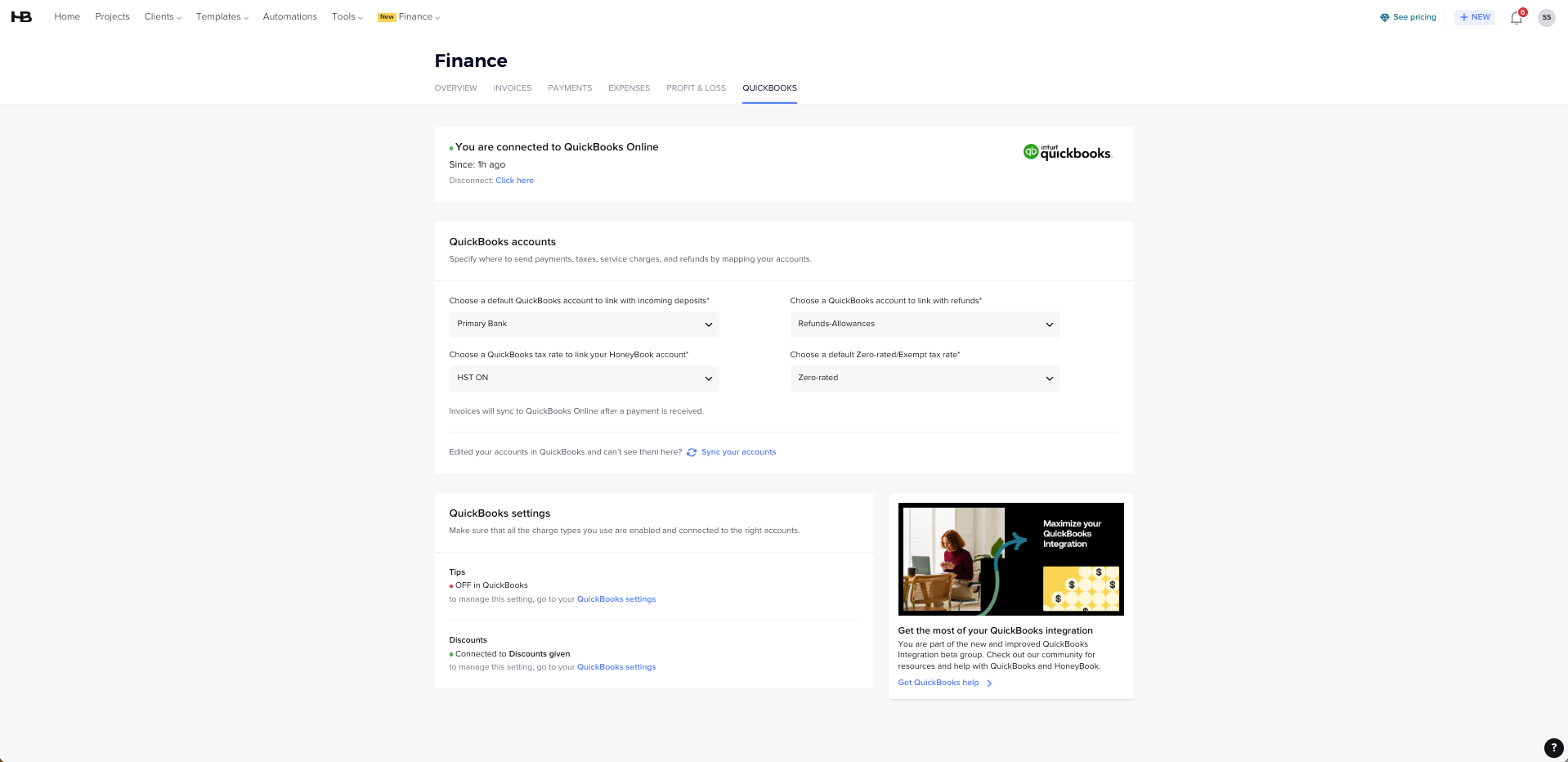

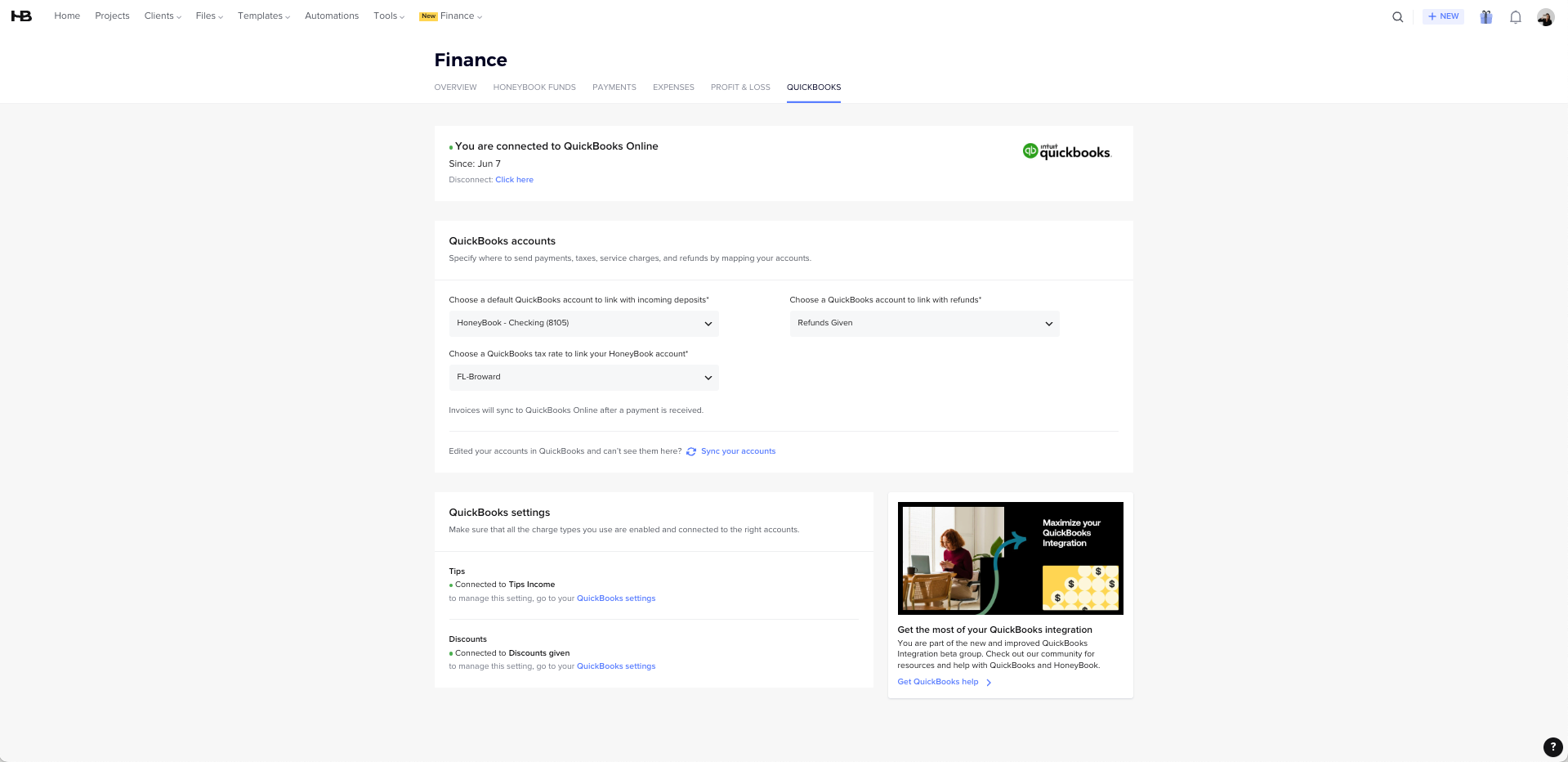

Connection flow is within HoneyBook and requires accounts to be set up in new dashboard experience with contains options to control where payments, discounts, refunds, and tips report (all which were previously not being reported in QuickBooks). Read more about the new dashboard here, or check our detailed post and discussion about the new dashboard here.

Canadian accounts

American accounts

Refunds

Any refunds issued in HoneyBook automatically will create a refund receipt or updated deposit and automatch to their associated invoices. A dropdown on the dashboard has also been added with the ability to select the chart of account that refunds should report to. Check out our detailed post and discussion about this feature here

Discounts

We have added a new indicator on the dashboard to show the status of the discounts setting in QuickBooks. This setting must be turned ON to properly sync discounts from HoneyBook to QuickBooks. We have also overridden the default QuickBooks setting to always “apply discounts after tax” and ensured that if this is not selected in HoneyBook, it is not automatically selected in QuickBooks. Discounts are now automatically and accurately reflected before sales tax in QuickBooks, matching your HoneyBook invoice. Read more about discounts in HoneyBook and QuickBooks here.

Service Mapping

HoneyBook now allows you to map the services you sell in your HoneyBook invoices directly to the services you’ve created in your QuickBooks account. This new feature gives you greater control over your financial reporting and ensures accurate tracking of your profit and loss. Read more about this feature and join the discussion here.

TIP: After assigning a QuickBooks service, be sure to click outside of the services box on the invoice to save your selection before moving on to the next service. Please know that we’re currently working on fixing this bug for you!

Service Charges

With service mapping we are now able to accurately allow for service charges to be billed on smart files. Read more about this here.

Invoice Syncing

Any changes after an initial payment to the invoice in HoneyBook, including adding services, removing services, and expiring the invoice will now reflect accurately in QuickBooks. How it Works

Instant Deposit Fees

Any transaction fees, including instant deposits, will now be reflected in QuickBooks accurately. Read more about this here.

On the roadmap

Expanded bookkeeper access - Bookkeeper access in HoneyBook currently allows bookkeepers to view payments; however, they do not have access to the associated invoices or any further detailed information related to those payments. Additionally, while bookkeepers can be granted access to multiple brands, there are still limitations in the multi-brand functionality, meaning they might not have a seamless experience managing different brands within the same HoneyBook account. Bookkeepers are also unable to access features related to HoneyBook Capital or HoneyBook Finance at this time. We fully recognize that these limitations impact the effectiveness of bookkeepers using our platform.

Refunds with sales tax - Currently all refunds are mapped to the “refunds issued” chart of accounts (selected on the QuickBooks dashboard). We are working to ensure that refunds with sales tax behave accurately in QuickBooks, including coming off of the various reports and liability account. Stay tuned for updates on this.

HoneyBook Capital - We are working on ensuring that your HoneyBook Capital loan, fees, liability amount and payments are recorded accurately in QuickBooks.

Below are a list of features we are not able to build at this time.

Accrual accounting - Since HoneyBook's reporting and invoicing system is designed with Cash accounting as its foundation—which records income and expenses only when money is actually received or paid out—we are currently unable to support Accrual accounting in QuickBooks. Accrual accounting, in contrast, recognizes income and expenses when they are earned or incurred, regardless of when the actual cash transaction occurs. Additionally, the ability to record deposits or retainers for work not yet performed is a function we are also currently unable to support.

Syncing invoices before they are paid - For the same reasons as above we are unable to sync invoices to QuickBooks before a payment is recorded due to the complexity of recording unearned revenue/accounts receivable.

Syncing payments recorded before the integration was connected - We explored potential solutions to enable the integration of payments and invoices that were recorded before the HoneyBook and QuickBooks connection was established. While this is a feature we may consider adding in the future, we recognized that adjusting prior accounting periods presents significant challenges. Adjustments to previous periods can impact financial accuracy, potentially leading to discrepancies or the need for extensive reconciliations. Additionally, there is a high likelihood that these payments could be duplicates, causing further complications in your books.