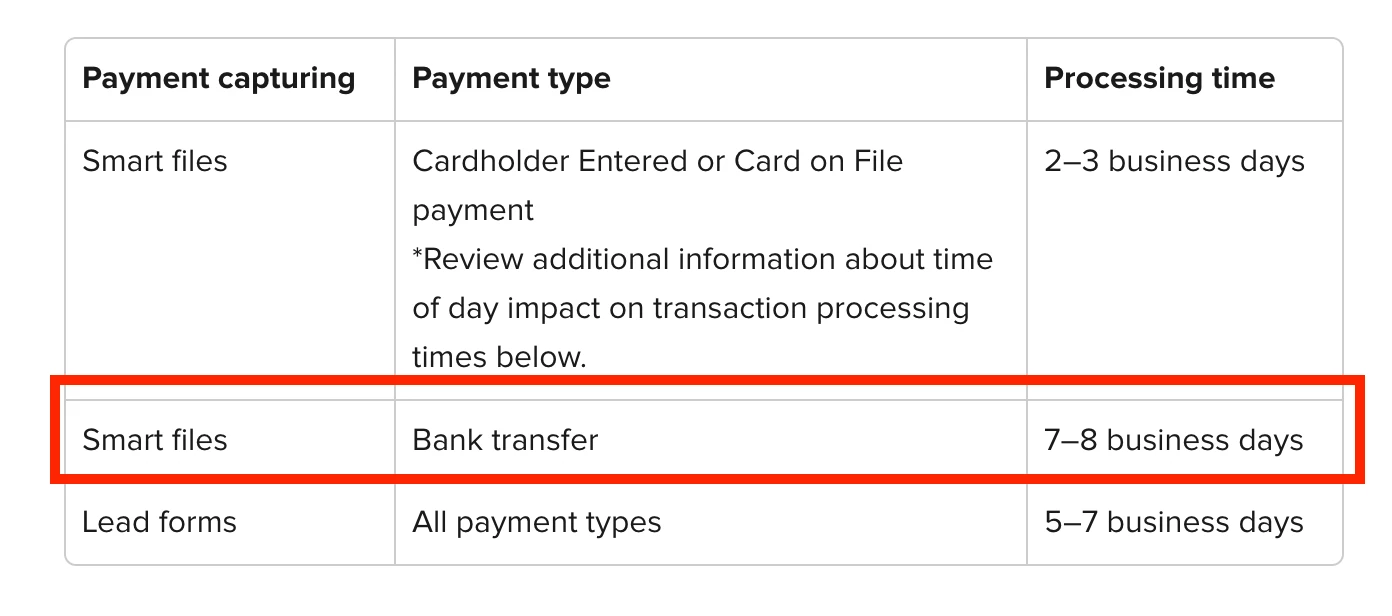

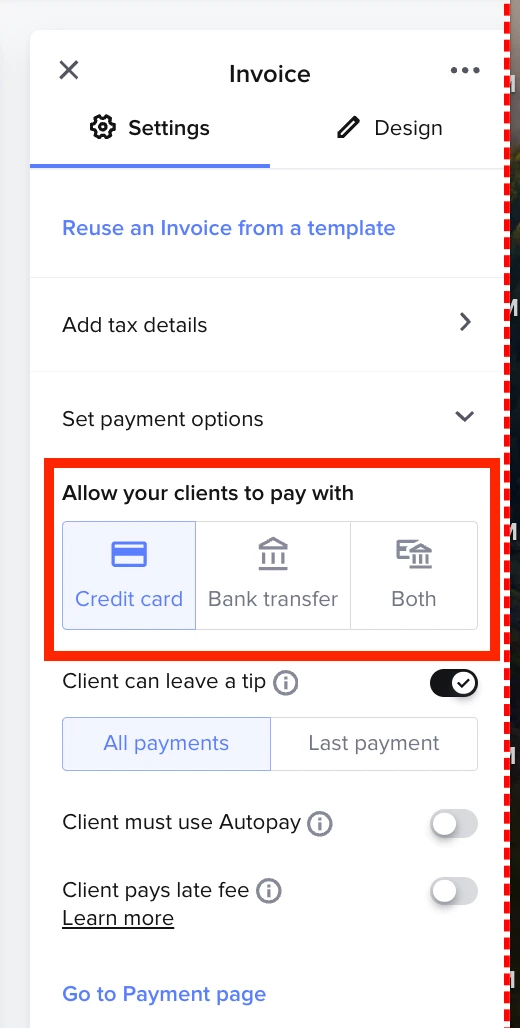

Has anyone heard an explanation from Honeybook why it takes 7-8 days for ACH payments to post to your bank account? That seems awfully long considering other options like Quickbooks take 24-48 hours to post ACH transactions.

I feel 7-8 days is a significant time to take for payments to post. Could be a real problem for many companies cash flow.